The Essential Role of a Tax Lawyer in Business Success

In today's complex and ever-evolving business landscape, understanding the intricacies of tax law is crucial for maintaining financial health and ensuring compliance. Whether you operate a small retail store or a large department store chain, the advice and representation of a tax lawyer can be invaluable. This article delves into how engaging a tax lawyer not only mitigates risks but also opens doors for strategic business advantages, specifically in sectors such as Department Stores, Shopping, and Fashion.

Understanding the Role of a Tax Lawyer

A tax lawyer specializes in the legal aspects of taxation. They provide guidance on a variety of tax issues, including compliance, planning, litigation, and audits. The expertise of a tax lawyer is not limited to federal tax regulations; they are also knowledgeable about state and local tax laws, which can vary significantly.

Key Functions of a Tax Lawyer

- Tax Planning: Strategic advice on tax reduction and compliance to optimize financial outcomes.

- Compliance Assistance: Ensuring adherence to tax laws, thereby avoiding penalties and fines.

- Representation: Acting on behalf of the business during audits, disputes, or litigations with tax authorities.

- Legal Interpretations: Providing clarity on tax codes and how they relate to business operations.

- International Tax Issues: Addressing complexities that arise with cross-border transactions.

Why Every Business Needs a Tax Lawyer

As a business owner, it's crucial to recognize that navigating the tax landscape without professional guidance can lead to costly mistakes. Here are several compelling reasons why hiring a tax lawyer should be a top priority:

1. Navigating Complex Regulations

The tax code is notoriously intricate and subject to frequent changes. A well-versed tax lawyer helps businesses stay up-to-date and navigate these complexities, ensuring compliance with all applicable laws and regulations.

2. Risk Mitigation

By understanding the legal landscape, a tax lawyer can identify potential risks associated with business decisions. This foresight enables companies to make informed decisions that align with tax strategies, thus minimizing financial exposure.

3. Cost Savings

Investing in a tax lawyer can lead to significant cost savings over time. Effective tax planning can reduce tax liabilities, allowing businesses to allocate funds more effectively towards growth and innovation.

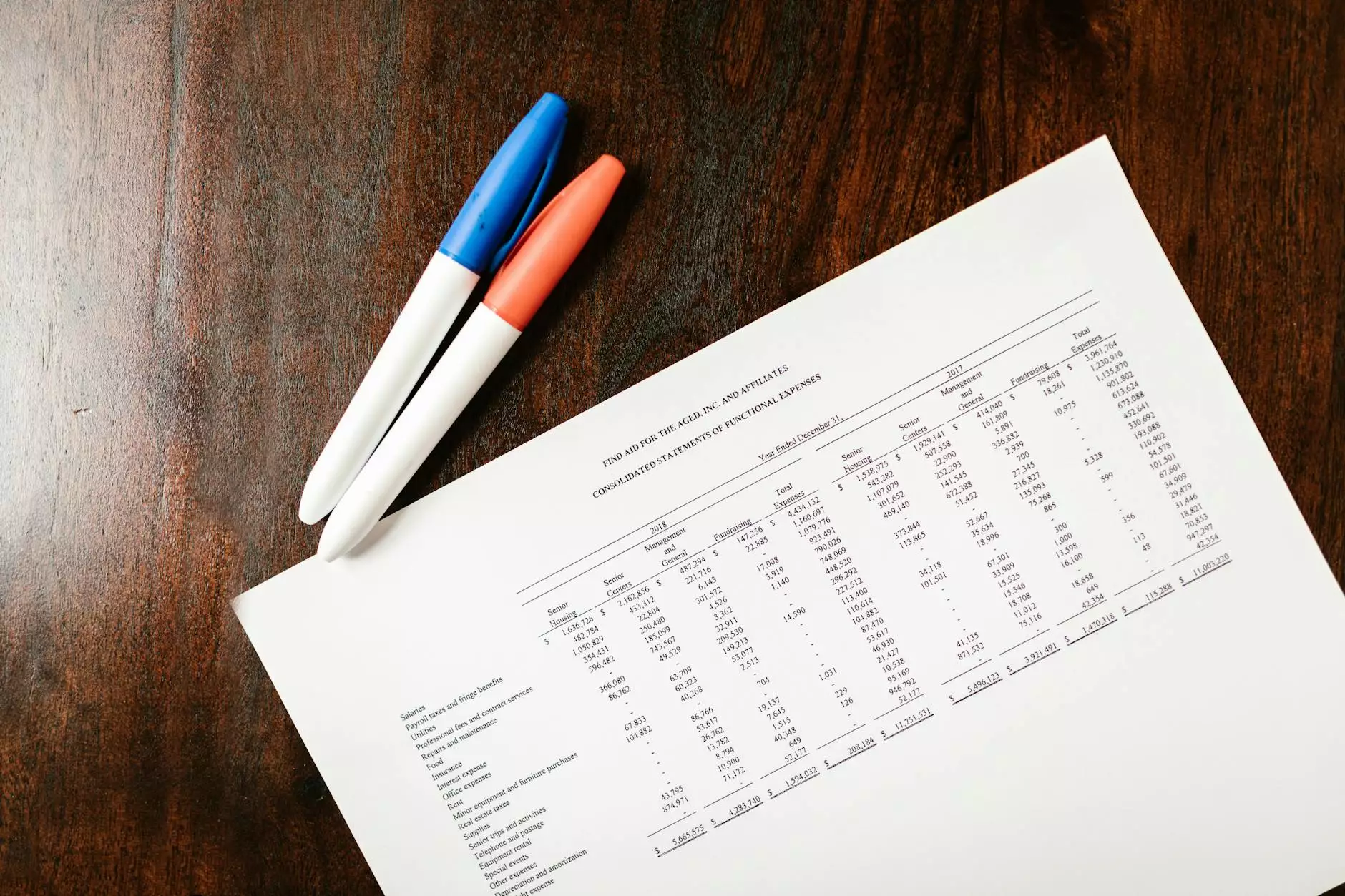

4. Audit Protection

In the event of an audit, having a tax lawyer on your side is a major advantage. They can prepare your business' documentation, represent you in meetings with tax authorities, and negotiate on your behalf, thereby alleviating much of the stress associated with audits.

Industry-Specific Considerations: Retail and Fashion

The retail and fashion industries have unique tax implications due to their operational structures, inventory management, and sales practices. Here’s how a tax lawyer can specifically assist businesses in these areas:

Sales Tax Compliance

Retail businesses are often required to collect sales tax, which varies by state and locality. A tax lawyer can help ensure your business complies with the diverse and often confusing sales tax laws:

- Understanding jurisdictional laws: Different states have different sales tax rates and regulations.

- File accurate returns: To avoid penalties, it’s essential to submit timely and correct filings.

- Manage exemptions: Identifying and applying for tax exemptions on products can lead to significant savings.

Inventory Tax Issues

In the fashion industry, managing inventory can also lead to complex tax situations. A tax lawyer assists in:

- Allocating Costs: Determining fair market value and ensuring compliance with accounting standards.

- Calculating Taxes Effectively: Ensuring that your inventory taxes are calculated based on the most tax-efficient methods.

International Sales and E-commerce

With the rise of e-commerce, many businesses are now selling globally. A tax lawyer can provide invaluable insight into:

- International Tax Treaties: Understanding how treaties can affect tax liabilities for overseas operations.

- VAT Compliance: Ensuring compliance with Value Added Tax (VAT) regulations in various countries.

Choosing the Right Tax Lawyer for Your Business

Selecting the ideal tax lawyer for your business involves careful consideration. Here are some tips to help you find the right fit:

1. Expertise and Experience

Opt for a lawyer who specializes in tax law and has substantial experience working with businesses in your industry. This ensures they understand your unique challenges and opportunities.

2. Reputation and References

Research potential candidates by checking online reviews, testimonials, and asking for references. A reputable tax lawyer will have a track record of success.

3. Communication Skills

Effective communication is essential for a productive relationship with your tax lawyer. They should be able to explain complex tax issues in an understandable manner.

4. Fee Structure

Understanding the lawyer's fee structure is critical. Ensure their fees align with your budget and that you understand any additional costs that may arise.

Conclusion: The Strategic Advantage of a Tax Lawyer

In conclusion, the role of a tax lawyer is pivotal in steering your business towards success. With their expertise in tax law, businesses in the Department Stores, Shopping, and Fashion sectors can navigate the complexities of tax compliance, mitigate risks, and optimize their financial performance.

By fostering a strong partnership with a tax lawyer, businesses are not only safeguarding their interests but are also positioning themselves for future growth and profitability. As the business landscape continues to evolve, the insight and protection provided by a tax lawyer could prove to be one of your most valuable business assets.